Tourism targets sound simple. Pick a number, build a campaign, post a countdown, celebrate when you hit it. But tourism does not grow on slogans. It grows when a destination feels easy, fair, and worth the money. [1]

That is where the Philippines faced added pressure in the 2024–2025 window. [2]

Travelers do not book a destination because a tourism office announces a target. They book when the trip feels simple to plan, easy to move through, and honest about total cost. In the Philippines, those “small” experience details became the real story in the 2024 to 2025 stretch.

This article explains why the gap between targets and outcomes mattered, even with real progress in arrivals. It breaks down how pricing, add-on fees, and travel friction can quietly change demand. It also frames the bigger choice ahead: chase volume, or improve value and ease in a way that lasts.

Key Takeaways

- The Philippines’ recovery improved, but lagged neighbors that reached closer to pre-2019 levels.

- Early 2025 trends did not signal a breakout, with foreign arrivals looking more constrained than accelerating.

- Domestic flights and multi-step island travel can push total trip costs higher than many expect.

- Layered fees can create “everything costs extra” fatigue when totals are not clear upfront.

- Competitiveness now hinges on ease, transparency, and reliability as much as scenery.

What the Numbers Say About the Recovery

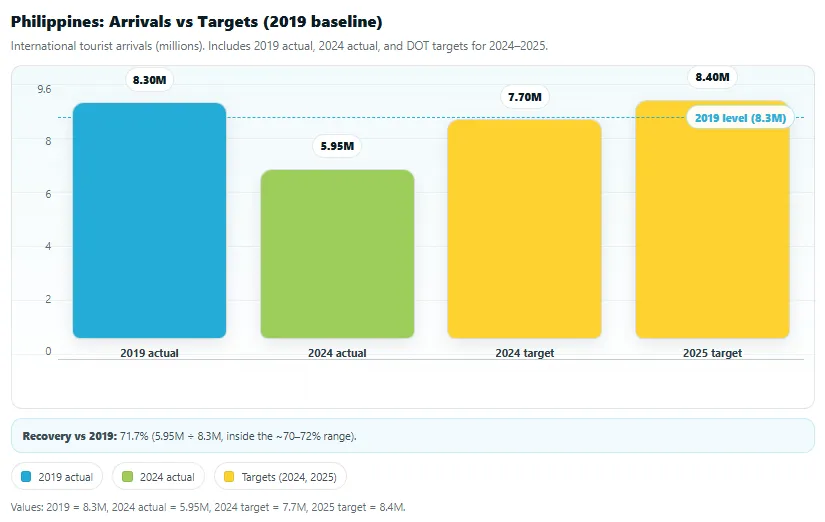

The country ended 2024 with about 5.95 million international tourist arrivals, or roughly 70% to 72% of its 2019 level (about 8.3 million). That is progress, and it also shows the recovery has been more gradual than many expected. [3]

The country ended 2024 with about 5.95 million international tourist arrivals, or roughly 70% to 72% of its 2019 level (about 8.3 million). That is progress, and it also shows the recovery has been more gradual than many expected. [3]

At the same time, the Department of Tourism set an ambitious path: 7.7 million in 2024 and 8.4 million in 2025. The point is not ambition. The point is that outcomes often depend on how the overall travel experience feels in real conditions for visitors. [4]

Early 2025 Did Not Show a Breakout Year

Early 2025 data did not strengthen expectations of a major jump. From January to May 2025, the Philippines recorded 2.54 million foreign arrivals. The same period also showed a slight year-on-year dip, with “pure foreign tourists” down as well. In other words, the first part of 2025 looked more like steady movement under constraints than a clear runway toward a large full-year leap in arrivals. [2]

The Region Recovered Faster

Now zoom out and compare the competitive set. While the Philippines sat around 70% recovery in 2024, Thailand and Singapore were closer to 90%, and Vietnam was described as reaching 100% of its 2019 levels. [5]

That kind of gap matters because most travelers do not decide in a vacuum. They decide between options that feel similar on Instagram. If one destination is easier to book, easier to move around, and more transparent at checkout, that destination is more likely to be chosen. [1]

Why the Philippines Fell Behind on Competitiveness

This is not about assigning fault or singling out any group. It is about what many travelers weigh when comparing destinations, and what can shape perceived value from planning to checkout. Common pressure points discussed for the Philippines include higher travel costs, layered fees, limited air connectivity on certain routes, and infrastructure and logistics constraints. [1]

Cost: The Philippines Is Quietly Becoming Expensive

Many visitors still assume the Philippines is a budget destination, but internal travel can be priced at levels that surprise people. One example often cited is that a round-trip Manila–El Nido flight can cost ₱14,000 to ₱16,000 per person. [4]

When moving around the country feels like a premium purchase, the value equation becomes harder for price-conscious travelers, families, and groups. [4]

Fees: The Death by a Thousand Cuts

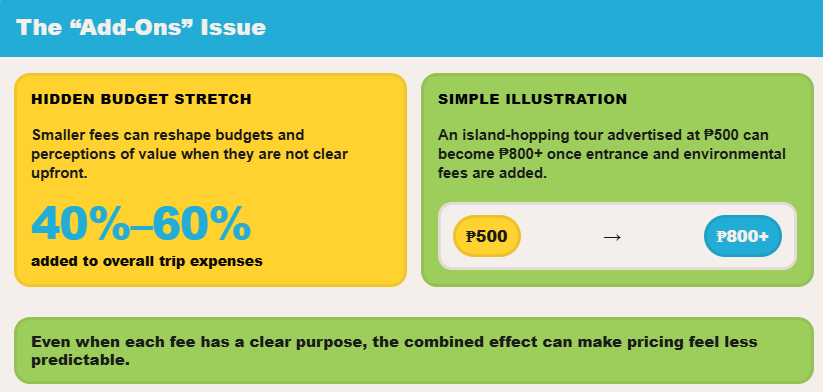

Then there is the “add-ons” issue: fees and charges that accumulate across a trip. Smaller costs can reshape budgets and perceptions of value, especially when they are not clear upfront. Add-ons are sometimes described as adding 40% to 60% to overall trip expenses. [1]

A simple illustration makes this real: an island-hopping tour advertised at ₱500 can become ₱800 or more once entrance and environmental fees are added. Even when each fee has a clear purpose, the combined effect can make pricing feel less predictable. [1]

Logistics: A Dream Trip That Feels Like a Puzzle

Finally, there is friction. The Philippines is an archipelago, so travel will never be as simple as a single train ride across a mainland. But friction is not just geography. It is also capacity, connections, and reliability.

Limited inter-island connectivity and congested airports can turn a straightforward itinerary into a planning puzzle. NAIA has been reported as operating beyond its designed capacity at times, and delays can ripple through itineraries, lead to missed connections, and increase the real cost of travel.

The Real Issue Is Value and Ease

Put these together and the picture becomes clear: competitiveness is influenced by value and ease, not only by natural attractions. Competing destinations often gain an edge when they feel simpler, more predictable, and more transparent on total cost.

What matters most now is not just hitting a number. It is reducing friction, improving value for money, and deciding what kind of tourism the country wants to build over the next decade.

The Philippines Isn’t “Cheap” Anymore

The Budget Reputation Is Out of Date

For years, the Philippines has often been described as a place for world-class beaches at bargain prices. That reputation still appears in travel forums and TikTok reels. But many visitors arriving today notice that overall trip costs can feel higher than expected. Not always through a sudden change, but through gradual increases that add up across an itinerary.

The surprise often shows up in two moments. First, when travelers compare accommodation and activities in popular areas and see prices that can sit in a similar range to Thailand or Vietnam. Second, when they plan to move between islands and find that transport can be one of the largest parts of the budget. [5]

None of this means the Philippines is universally expensive. There are still great-value destinations and genuinely affordable pockets. The difference is that the country is not always assumed to be the lowest-cost choice by default. When price is not the automatic advantage, trips tend to be judged more on overall value.

Sticker Price vs Total Trip Cost

Many travel decisions start with sticker prices. A room rate looks reasonable, a tour seems affordable, and a destination appears “budget-friendly.” But travelers do not experience sticker prices. They experience totals.

Many travel decisions start with sticker prices. A room rate looks reasonable, a tour seems affordable, and a destination appears “budget-friendly.” But travelers do not experience sticker prices. They experience totals.

That total can include:

- Transfers

- Local transport

- Port and terminal fees

- Environmental fees and entrance fees

- Boat rides and baggage add-ons

- Time lost to delays and long connections

- Stress, uncertainty, and effort

Two destinations can have similar sticker prices yet feel very different in total cost. That difference often comes from how many separate steps and add-ons sit between booking and arrival. In some places, routes may feel more straightforward or bundled. In others, travelers may encounter more separate payments, separate queues, and separate information points. Each step might be manageable on its own, but the combined effect can shift the sense of value.

The country does not need to be the cheapest destination in Southeast Asia. It needs to feel fair. And fairness is often experienced emotionally: people accept paying more when the process is smooth, transparent, and reliable.

Accommodation Prices and the “Value Gap”

Accommodation is where expectations can meet reality in a very direct way.

In many flagship destinations, room rates have climbed into a range where travelers expect a certain level of service: consistent cleanliness, reliable hot water, good Wi-Fi, smooth check-in, clear policies, responsive staff, and transport support that feels organized. When the experience matches, price rarely becomes a complaint.

But when experiences vary, travelers start evaluating value differently. They stop asking, “How much is this room?” and start asking, “What am I getting for what I paid?”

This is where “expensive” becomes less about the invoice and more about comparisons that happen in a traveler’s mind: [5]

- “I paid about the same in Thailand and had easier transport.”

- “Vietnam felt smoother for the same budget.”

- “Malaysia had clearer pricing and fewer surprises.”

Even small breakdowns tend to matter more at higher price points. When a place feels cheap, travelers often tolerate inconvenience. When a place is priced closer to premium, inconvenience can feel more noticeable.

Domestic Flights: The Shock Factor

If there is one cost that can change the entire budget conversation, it is domestic airfare. [4]

Many travelers can justify paying for a resort, tours, and dining. But when moving around the country costs what feels like an international flight, the Philippines can shift from a casual, spontaneous destination to a higher-commitment trip. [4]

This matters because island travel is part of the Philippines’ appeal. The destination is not selling one city break. It is often sold as the option to move between islands, explore provinces, and build multi-stop itineraries. When the price of movement becomes a key constraint, it can influence how people plan. [4]

It can also influence traveler behavior in ways that affect overall numbers:

- Short-stay travelers may choose a country where they can do more with fewer transfers

- First-timers may pick a simpler itinerary, or choose a different destination

- Repeat visitors may delay a return trip depending on budget and timing

- Visitors who do come may stay in one area, reducing dispersion to provinces

The same geography that creates variety can also raise the cost of movement, shaping how the destination feels at checkout. [6]

Fees and Add-Ons: The “Everything Costs Extra” Feeling

Beyond flights, another factor that can shape the “not cheap anymore” perception is layered fees.

Beyond flights, another factor that can shape the “not cheap anymore” perception is layered fees.

Environmental fees and conservation charges often exist to fund maintenance, manage carrying capacity, or support communities. The issue is less about whether fees exist and more about how they are experienced and understood.

When travelers encounter multiple small charges with limited explanation and no single place to see the full total upfront, it can feel less predictable. It can feel like the price keeps shifting, which makes planning harder.

A simple example makes this easy to see: a tour that looks like ₱500 on a poster can become ₱800 or more once entrance fees and environmental fees are added. The change may not be unreasonable on its own. The surprise is often what stands out. [6]

Surprise costs tend to do three things at once:

- Raise the total spend

- Create stress and “budget anxiety”

- Reduce confidence in planning

When visitors describe the trip to friends, they rarely list every charge. They summarize it as “it cost more than expected,” or “there were lots of add-ons.” Those summaries spread quickly and shape perception.

What “Value for Money” Really Means to Travelers

Travelers usually feel value through everyday moments rather than formal equations. Value tends to show up across a handful of practical checkpoints.

- Transport and ease

- Are routes straightforward?

- Are schedules reliable?

- Is it easy to get from airport to hotel and back?

- Reliability

- Do promised services happen on time?

- Do bookings match what was advertised?

- Is there a clear backup plan when conditions change?

- Cleanliness and basic standards

- Not luxury, just consistency

- Clean rooms, clean bathrooms, clear waste management

- Public areas that look cared for

- Safety perception

- Not just actual safety, but how safe it feels

- Lighting, signage, transport credibility, clear rules, helpful staff

- Customer service consistency

- Travelers often forgive honest mistakes

- They struggle more with unclear policies and “figure it out yourself” systems

This is why the Philippines can feel expensive even when some individual items are reasonably priced. Value is judged as a whole experience. If the experience feels fragmented and effort-heavy, the total spend can feel heavier too.

A Better Lens: Expensive Relative to Friction

It can help to reframe the conversation.

The issue is not simply “the Philippines is too expensive.” The issue is that travelers can experience the price as higher relative to the amount of effort required to make the trip smooth. When a destination is pricey but seamless, many travelers describe it as premium. When a destination is pricey and requires more steps, it can be described as weaker value.

Friction is often what turns cost into a complaint. Travelers commonly describe friction in terms of:

- Multiple transfers

- Unclear pricing

- Long waits and congestion

- Inconsistent standards between operators

- The sense that everything requires extra steps

This is why regional competition matters [7]. Many visitors experience Thailand and Vietnam as easier to navigate for point-to-point movement. When two destinations compete for the same traveler, the easier one can feel more predictable. [5]

Island Geography Raises Costs, But It Doesn’t Have to Raise Frustration

Yes, the Philippines will always face structural challenges. An archipelago requires flights, ferries, and boats. Weather can disrupt plans. Distances that look short on a map can take a full day in real life. [6]

Yes, the Philippines will always face structural challenges. An archipelago requires flights, ferries, and boats. Weather can disrupt plans. Distances that look short on a map can take a full day in real life. [6]

But geography does not have to determine the full experience. [6]

Some frustration is less about the sea and more about how systems connect:

- Poorly coordinated schedules

- Unclear transport information

- Separate fee collection points

- Limited integration between airports, ports, and local transport

- Inconsistent standards and enforcement

Island travel can feel smoother when the “last mile” is designed with travelers in mind:

- Clear, unified ticketing

- Upfront display of total costs

- Predictable transfer routes

- Realistic time expectations

- Fewer “surprise steps” after arrival

The goal is not to eliminate complexity. It is to make complexity easier to navigate and budget for.

What Travelers Will Forgive, And What They Won’t

Travelers are often more flexible than debates suggest. People accept higher prices when they understand why. They tolerate inconvenience when they feel supported. They even enjoy “rough edges” when expectations are clear.

What tends to be hardest to accept is the combination of:

- Surprise costs

- Unclear rules

- Long, unplanned delays

- Service inconsistency

- The feeling of being directed from one payment point to another

In short, travelers often accept price. They are less comfortable with confusion.

That is why “cheap” may no longer be the strongest pitch on its own. A stronger pitch is “worth it.” And “worth it” is supported by clearer totals, fewer surprises, and a smoother experience from arrival to departure.

Hidden Fees: The Death by a Thousand Cuts Problem

You Arrive. Then You Pay. Then You Pay Again.

The fee experience in the Philippines is not always defined by one large charge. More often, it is the pattern of smaller charges across a trip. A traveler arrives and pays a fee. A transfer involves another cost. A boat ride includes a separate payment. An island entry may require a charge. A tour can include an additional collection point.

Each payment can be small enough to feel manageable in the moment. But travelers often remember the overall impression more than individual receipts. When the full total is not clear from the start, the experience can feel less predictable. That matters because travel decisions are shaped by confidence. People often spend more readily when costs feel clear, and they tend to hesitate when totals feel uncertain.

Research suggests that add-on or surprise fees can add roughly 40% to 60% to total trip expenses in some cases [1]. Even if the exact percentage varies by itinerary, the general point is consistent: trips can feel more expensive when costs appear in steps rather than as a single, clear total.

Fees Are Not the Enemy. Confusion Is.

Fees are not automatically negative. Many exist for practical purposes such as conservation, waste management, maintenance, crowd control, and local community support. The key factor is often how those fees are communicated and collected.

When charges are spread across multiple steps, collected by different offices, and explained in different ways, the process can feel less straightforward. Travelers may not immediately connect a fee to its purpose if it appears as a line item without clear context.

Where the Fees Show Up in Real Life

Fees often appear in the “in-between” parts of a trip, when travelers are moving between locations and trying to stay on schedule.

At airports, travelers may encounter baggage rules, add-ons, and transport choices early in the journey. When extra costs appear at the start, they can feel more noticeable because people are still orienting themselves.

Then come ports and ferries. Inter-island travel can involve separate queues and separate counters for what feels like one continuous journey. Even when totals are not large, the process can feel more complex when payments are broken into multiple steps. Multiple small charges across several stops can shape an overall perception of the travel process.

Island entrance and environmental fees are often easy to understand in principle, but experiences vary depending on how they are explained. A visitor may pay one fee at a checkpoint, then see another nearby for a related purpose. If signage is unclear, payment is cash-only, or amounts vary depending on location or collector, it can feel inconsistent. That inconsistency is often what makes a reasonable fee feel harder to interpret.

Tours can be another common pressure point because headline prices can look low until arrival. A booking may exclude entrance charges, gear rental, or local fees that are collected on the ground. This is not always the result of wrongdoing. It can reflect how pricing is structured. But from the traveler’s perspective, it can feel like the total cost was not visible at the start.

The same pattern can occur with transfers and add-ons. In itineraries that involve multiple flights, boats, and vans, separate charges can accumulate quickly. Baggage fees are not unique to the Philippines, but they tend to stand out more when trips involve several legs instead of one.

Even small banking costs can add to the sense of effort. Many fee points still rely on cash payments. That can mean extra ATM visits, potential withdrawal fees, and added planning in areas where machines are limited [1]. Practical issues like payment availability can affect mood and perceived convenience during travel days.

Finally, some destinations require accredited guides or specific operators. This can support safety and environmental goals, and it can also affect budgets when requirements are not clearly communicated in advance. When travelers do not know what will be required until arrival, costs can feel unplanned, especially if rates are not easy to verify upfront.

What Visitors Tell Friends After the Trip

Most travelers do not return home and list every fee. They often summarize the experience in a simple line: “It was more expensive than I expected,” or “There were many extra charges.” Even travelers who enjoyed the scenery may frame advice around budgeting and planning rather than only attractions.

That is why unclear totals can affect more than budgets. They can influence repeat intent. And repeat intent tends to be an important driver of steady tourism growth over time.

The Fix Is Transparency, Not Zero Fees

The goal is not to remove fees. Many destinations use fees to protect fragile sites and fund basic services. The practical goal is to reduce surprise. When visitors can see the full total upfront, fees often feel more like part of the destination’s management plan than an unexpected penalty.

A practical approach is to reduce the number of payment moments and make pricing easier to verify. Options can include bundling common charges into a single pass to reduce multiple counters, publishing official fee lists in one place, using consistent receipts, and expanding payment methods. These steps can shift the experience from “unplanned add-ons” to “clear expectations.”

Even a short, plain-language explanation can help. A one-line note such as “This fee supports reef protection and waste management” can make people more comfortable paying, especially when the purpose feels visible in how the area is maintained.

Logistics: The Philippines Is Beautiful But Logistically Hard

A Country Built for Island Dreams, But Not Always for Easy Movement

The Philippines is often associated with a clear travel image: turquoise water, small islands, slow sunsets, and a trip that feels like an escape. But when travelers try to move between islands, the trip can quickly become planning-heavy and time-intensive.

The Philippines is often associated with a clear travel image: turquoise water, small islands, slow sunsets, and a trip that feels like an escape. But when travelers try to move between islands, the trip can quickly become planning-heavy and time-intensive.

That is the core logistics reality. The Philippines can be easy to appreciate, and it can take more effort to navigate from place to place.

Being an archipelago naturally adds complexity. Flights, ferries, and weather are part of the geography. But geography is not the only factor. Many island destinations still feel smooth when systems reduce friction. In the Philippines, friction is often linked to how travel is connected: multiple separate steps, bottlenecks at major gateways, and less predictability outside major hubs.

For many travelers, the biggest surprise is not the beach. It is the amount of time and energy required to reach the beach.

Limited Direct Flights to Secondary Gateways

One reason trips can feel complex is the structure of air access. Many international visitors still enter through main gateways, then connect again to reach the places they plan to visit.

For travelers, direct access is more than convenience. It supports confidence. A direct flight to a secondary gateway reduces the number of connection points where plans can be disrupted. It can reduce missed connections, baggage complications, overnight delays, and “we lost a day” outcomes.

When direct options are limited, visitors often follow a familiar sequence:

- Arrive at a main gateway

- Wait for the domestic connection window

- Fly again to a smaller airport

- Transfer by van, then boat, then tricycle or shuttle

- Arrive later than planned, with more fatigue and less usable time

That structure also influences itinerary choices. When reaching multiple provinces requires several transfers, travelers often simplify. They select one base, stay longer, and reduce island-hopping. This can limit dispersion beyond hotspots and reduce the overall feeling that the Philippines is easy to explore.

Congested Airports and the Domino Effect of Delays

Airport congestion is more than an inconvenience. In an archipelago, it can affect multiple legs of a trip.

When a main gateway operates under strain, delays can cascade. One delayed flight can become a missed connection. A missed connection can become a rebooked departure the next day. A rebooked departure can mean a canceled tour, a lost hotel night, and a traveler who feels less settled in the experience.

NAIA has been operating beyond its designed capacity [4]. That kind of pressure can show up in the traveler experience through:

- Long queues

- Delayed departures

- Unpredictable boarding times

- Baggage delays

- Limited recovery options when disruptions happen

It can also shape first impressions. When the arrival gateway feels busy and unpredictable, travelers may become more sensitive to later costs, waits, and unclear steps. First impressions matter, and a stressful start can make the rest of the trip feel more effortful.

Inter-Island Connectivity Gaps: Reliability Matters More Than Speed

Travel within the Philippines is not always slow by distance. It can feel slow in practice.

Travel within the Philippines is not always slow by distance. It can feel slow in practice.

A flight might be short, but the end-to-end journey often is not. That is because travel time is not only moving time. It includes waiting, transfers, buffers, and uncertainty.

The gaps often appear in a few recurring ways.

Schedule reliability

- Inter-island connections can depend on tight timing. Even a small delay can break a chain of transfers. Travelers generally accept time spent on a boat or in a van when it feels planned. It feels harder when schedules are fragile and one disruption can reshape the day.

Transfer time that doesn’t match the map

- In many itineraries, the main time sink is not the flight. It is what happens before and after: arriving early, waiting to board, landing, collecting bags, locating ground transport, then aligning with a boat schedule. What looks like a simple hop can become a long series of small steps.

Weather disruptions that hit harder because backups are limited

- Weather is part of island travel, and most travelers understand that. Disruptions can feel heavier when alternatives are limited. When flights and boats are infrequent, one cancellation can mean waiting a full day for the next available option. For short holidays, losing a day can materially change the trip.

Information gaps

- Travel feels harder when information is inconsistent. Visitors often struggle when schedules change without clear updates, when transport options are unclear, or when each step must be figured out on arrival. Uncertainty increases perceived risk, and risk can push travelers toward simpler options.

The “Two-Hour Flight, Whole-Day Travel” Problem

This is a moment that shapes many traveler impressions. The Philippines can turn a short flight into an all-day travel effort.

This is a moment that shapes many traveler impressions. The Philippines can turn a short flight into an all-day travel effort.

A typical “two-hour flight” day can look like this:

- Leave the hotel early because airport buffers are hard to predict

- Spend time in traffic or on long transfers to the terminal

- Wait through queues and boarding delays

- Fly for one to two hours

- Land and wait for bags

- Transfer again by van

- Wait for a boat schedule

- Travel by boat

- Arrive and check in late, with limited energy for activities

Even when each step is reasonable, the combined effect can be demanding. It is especially challenging for:

- Families with kids

- Older travelers

- First-time visitors without local knowledge

- People on short leave who want more vacation time and less transit time

After a day like that, comparisons become natural. Travelers think about destinations where they can land and reach their hotel with one transfer, or move between places with fewer steps. The difference is less about beauty and more about the effort required.

Why This Hurts First-Timers and Repeat Visitors Differently

First-time visitors are usually more sensitive to uncertainty. They do not yet know which transfers are reliable, which airports are easy to navigate, which routes are worth the effort, and what “normal” looks like. When the trip feels confusing, it can reduce confidence about returning.

Repeat visitors often respond differently. They already value the destination, and they also remember how much time travel required on previous trips. If the trip felt smooth, they return more readily. If a day was lost to delays or too much time was spent in transit, they may choose a simpler option for the next holiday.

This is one way logistics can quietly limit growth. It does not necessarily reduce interest in the destination. It can influence decisions when travelers want a trip that feels more straightforward.

A Better Standard: Make the Hard Parts Feel Designed

The Philippines will not be as simple as a single-city holiday, and that does not need to be the goal. The goal is for complexity to feel designed, not improvised.

When travel systems are designed well, visitors accept multi-step island travel because it feels clear and predictable. They know what to pay, how long it will take, what options exist if conditions change, and what to expect at each transfer point. That clarity reduces the need for travelers to solve logistics on their own.

That is what connectivity and airport performance mean for tourism. They are not just technical topics. They shape visitor confidence from arrival through departure.

Regional Competition: Neighbors Market Easier Experiences

The Philippines Is Competing in a Region That Recovered Faster

Tourism does not operate in isolation. Many travelers considering Southeast Asia are not deciding between “travel” and “no travel.” They are choosing among countries that look equally appealing in photos and offer similar promises: strong food culture, warm weather, beaches, heritage, and good value.

Tourism does not operate in isolation. Many travelers considering Southeast Asia are not deciding between “travel” and “no travel.” They are choosing among countries that look equally appealing in photos and offer similar promises: strong food culture, warm weather, beaches, heritage, and good value.

That is why regional recovery provides useful context.

That can influence perception. When travelers see strong momentum elsewhere, it can increase confidence in planning. When a destination appears to be recovering more gradually, some travelers may interpret that as “still rebuilding,” even if attractions and hospitality remain strong.

Confidence spreads. Caution does too.

“Ease” Is a Competitive Advantage, Not a Nice-to-Have

It is easy to assume travelers choose based on attractions alone. In practice, many decisions are filtered through practical questions:

- How easy is it to get there?

- How easy is it to get around?

- How predictable is the experience?

- How confident do I feel that my time and money will be used well?

In that sense, “ease” functions as a competitive advantage.

A destination that feels easy reduces mental load. It lets travelers focus on enjoying the trip instead of solving logistics. And once a place becomes known as an “easy choice,” it tends to attract more repeat visits, group travel, family trips, and first-timer bookings. Those segments are large, and they often scale faster than niche, high-effort itineraries.

The Philippines can deliver highly memorable trips. At the same time, many itineraries can require more planning and more transfer steps. For travelers seeking a simpler holiday, that extra planning effort can influence destination choice.

Total Cost vs Perceived Value: Where the Philippines Loses the Comparison

Many travelers do not compare countries using strict line-item spreadsheets. They compare by how the trip feels financially.

A destination can look “cheap” but feel expensive if costs are fragmented and unpredictable. Another destination can be more expensive yet feel fair because pricing is clear and bundled.

In this comparison lens, Vietnam and Thailand are often described by visitors as smoother and more transparent in how costs appear across a trip. Even when prices rise, travelers may see the full cost earlier and encounter fewer mid-trip add-ons that reshape the budget.

In the Philippines, costs can appear across the journey in multiple layers: entrance fees, environmental fees, transfers, port charges, add-ons, and cash-based payments. Even when totals are not dramatically higher than competitors, the experience can feel more expensive when pricing is less packaged and less visible upfront. [2]

Perceived fairness is often emotional. Travelers are more comfortable paying more when the system feels clear.

What Competitors Do Better Without Pretending They’re Perfect

This is not a claim that Thailand or Vietnam is flawless. Every destination has trade-offs. The useful comparison is what many visitors experience as easier in the moments that shape planning and comfort.

Clearer Pricing and Fewer Surprise Steps

In many cases, competitors make the “real price” easier to see upfront. That does not mean everything is low-cost. It means travelers are less likely to feel caught off guard.

When prices are clear, visitors can budget more confidently. When budgeting feels stable, travelers often spend more freely during the trip. That helps destinations maintain strong tourism receipts even as prices increase.

The Philippines does not need to remove fees. It benefits from reducing surprise. When the full cost of a tour, transfer, or site entry is visible from the start, the destination can feel more predictable and easier to plan for.

More Direct Flights and Better Gateway Options

Direct access often reduces complexity. Fewer connections can mean fewer points where itineraries can shift.

Many travelers select Thailand or Vietnam because they can:

- Land in a major gateway with frequent flights

- Connect quickly to secondary areas

- Avoid long transfer chains involving multiple transport modes

In the Philippines, limited direct access to certain secondary gateways can create longer connection chains. That adds time and can also add uncertainty, which can be a key factor for first-timers.

Even travelers who enjoy the Philippines often plan around what is easiest to reach rather than what they most want to see. That dynamic can shape competitiveness in a region where alternatives may feel simpler.

Smoother Airports and Ground Transport Experience

Airports shape first impressions. Ground transport shapes daily experience.

Airports shape first impressions. Ground transport shapes daily experience.

A smoother airport experience can mean:

- Fewer delays and less congestion

- Clearer signage and queue flow

- More predictable timelines

- Less stress before the holiday begins

A smoother ground transport experience can mean:

- Clearer options for getting around

- Less negotiation at each step

- Fewer surprises in pricing and routing

- Better connectivity between transport modes

Competitors are often described by visitors as performing well in these day-to-day touchpoints. Even without knowing the details, travelers feel the difference and summarize it as “easy,” “convenient,” or “smooth.” Those perceptions can influence group bookings and repeat travel.

When a destination feels effort-heavy, it may still attract first-time visits, but it can be slower to generate quick repeat trips and “low-stress holiday” recommendations.

Stronger Packaging and Simpler Planning

One reason Thailand and Vietnam can feel easier is planning. Many visitors can book a trip with fewer decisions.

Packages are not only resort bundles. They act as a planning system:

- Tours that include key fees

- Transport options that feel integrated

- Itineraries that are easy to understand

- Online information that aligns with on-the-ground conditions

When a destination supports simpler planning, it becomes more accessible to:

- Families

- Older travelers

- Groups of friends

- Short-stay visitors

- First-timers who prefer less complexity

The Philippines often rewards travelers who plan deeply, move slowly, and are comfortable with multi-step itineraries. That can be a strong positioning choice, but it can also limit volume for travelers who want a more plug-and-play trip.

Why the Philippines Still Wins on Something Important

It is also important to note that the Philippines has strengths that are difficult to replicate.

It is also important to note that the Philippines has strengths that are difficult to replicate.

The archipelago offers:

- A scale of beach variety that many mainland destinations cannot match

- Island experiences that feel genuinely “away”

- Cultural warmth and hospitality that visitors often remember for years

- Provinces that can feel less saturated than heavily traveled routes elsewhere

These strengths are why many visitors become loyal to the Philippines. The discussion point is less about the destination itself and more about the experience around getting to and through the destination.

Beauty creates interest. Ease supports bookings.

A Realistic Way to Compete: Reduce Friction, Don’t Copy Neighbors

The goal does not need to be turning the Philippines into a copy of Thailand or Vietnam. The country does not have to chase the same exact tourism model. A practical focus is reducing unnecessary friction that can make some travelers hesitate.

Competing on ease does not mean erasing what makes the Philippines distinctive. It can mean:

- Making totals clearer upfront

- Reducing the number of surprise payment moments

- Improving gateway flow and reliability

- Building smoother connections to secondary destinations

- Packaging experiences so first-timers can book with confidence

When ease improves, the Philippines can become more accessible to a wider range of travelers. That can support arrivals without pushing the country into a purely mass-tourism approach. It simply makes the destination easier to enjoy in practice, not only in photos.

The China Market Didn’t Return Like Before

The China Market Didn’t Return Like Before

Before the pandemic, China was one of the largest contributors to visitor volume for the Philippines. That mattered because China represented more than “additional tourists.” It often meant larger group movements, high seat utilization on certain routes, and strong visibility for key destinations. When that volume returns more slowly, it can be reflected in national totals even when other markets perform well.

By 2024, Chinese arrivals were still around 312,000, which is far below the pre-pandemic role China played in the overall tourism mix [1]. That gap helps explain why the national recovery can appear gradual even when peak seasons are busy and some source markets are growing.

Why This Matters Beyond the Headline Number

China’s lower volume can influence several moving parts at the same time.

Flight economics and seat capacity

Tourism volume is closely tied to air routes and seat availability. When demand is strong and consistent, airlines can justify more routes and better frequency. When demand is uncertain, route expansion tends to be more cautious. That can create a feedback loop where fewer flights reduce convenience, and reduced convenience can limit demand further.

Groups and scale

Chinese travel has historically included a significant group-tour segment. Regardless of travel style preferences, group volume can fill hotel inventory and move large numbers efficiently. When group volume is lower, the gap can be difficult to offset quickly through independent travel alone, especially when multi-stop travel requires more planning.

Spillover to secondary destinations

A stronger China market can also support more dispersion, particularly when packages include multiple stops. When that market is smaller, tourism activity can lean more heavily on destinations that are simplest to reach, which can concentrate demand in a few hotspots while other provinces see less spillover.

The Friction Multipliers: Visas and Flights

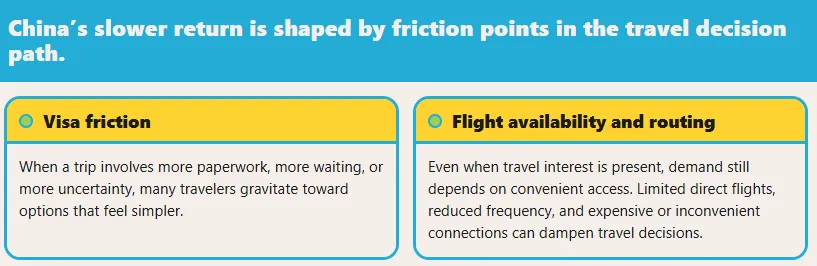

China’s slower return is not usually explained by a single factor. It is shaped by friction points in the travel decision path.

China’s slower return is not usually explained by a single factor. It is shaped by friction points in the travel decision path.

Visa friction

When a trip involves more paperwork, more waiting, or more uncertainty, many travelers gravitate toward options that feel simpler. This pattern is not unique to Chinese travelers. It applies broadly across markets when planning effort increases.

Flight availability and routing

Even when travel interest is present, demand still depends on convenient access. Limited direct flights, reduced frequency, and expensive or inconvenient connections can dampen travel decisions. In a region with many alternatives and dense flight networks, route convenience can become a deciding factor.

This is one area where the Philippines can face added sensitivity. When itineraries are already multi-step due to island geography, extra friction at the entry stage can have a larger effect on final demand.

Overreliance on One Market Is a Structural Risk

A broader lesson is not only that China returned more slowly. It is that heavy reliance on a single market can make performance more volatile.

When a destination depends heavily on one major source market, overall performance can start to feel like a single switch: strong when conditions align, weaker when they do not. If that market slows due to policy shifts, airline capacity changes, economic conditions, or travel trend movements, national totals can swing more sharply.

A more resilient tourism approach looks different. It may be less dramatic in boom years, but it also tends to be steadier in softer years. It is built on multiple markets contributing meaningful volume, so a slowdown in one does not dominate the national picture.

The Reality Check: South Korea Is Carrying a Lot of Weight

While China has been slower to rebound, South Korea remained the top source market, with about 1.439 million arrivals in 2023, representing roughly 26.4% of total arrivals that year. [4]

While China has been slower to rebound, South Korea remained the top source market, with about 1.439 million arrivals in 2023, representing roughly 26.4% of total arrivals that year. [4]

That is a strong foundation, and it also highlights a similar concentration dynamic in a different form. When one market represents a large share of arrivals, performance becomes more sensitive to changes in that market. If route capacity shifts, economic conditions change, or preferences move, the impact can be felt quickly.

The objective is not to “replace China” with Korea or any other single market. The objective is to build a balanced portfolio.

A Better Strategy: Multi-Market Stability, Not a Savior Market

Tourism planning sometimes falls into a familiar pattern: expecting one market to restore totals quickly. In practice, relying on a single “savior” market can increase vulnerability and reduce flexibility.

A more durable approach emphasizes stability and fit.

Stability means building a spread of markets where arrivals remain healthy even if one slows. It also means improving consistency so visitors return, because repeat travel is one of the most dependable forms of demand.

Fit means leaning into the kinds of trips the Philippines supports well, while reducing the friction that discourages other segments.

The Philippines tends to align strongly with travelers who:

- Stay longer

- Travel at a slower pace

- Mix beaches with provinces

- Value culture and nature

- Prefer a less rushed, less checklist-style trip

That is a strength. It can also become a constraint if basic travel elements remain more difficult than alternatives, such as clear pricing, smoother gateways, simpler transfers, and fewer surprise steps.

What Diversification Looks Like in Practice

Diversification is not only about marketing campaigns. It is also about designing an experience that attracts and retains multiple traveler types.

Here are practical levers that are often emphasized:

- Make entry and planning simpler

- When itinerary planning feels easier, more markets become viable. First-timers across countries tend to avoid uncertainty. Clear information, predictable transfers, and visible total costs reduce that uncertainty.

- Improve repeat intent

- Repeat visitors are one of the most stable sources of demand because they already trust the destination. Reducing pain points helps protect this advantage and supports steadier year-to-year arrivals.

- Support airlines with consistent demand signals

- When routes and capacity become reliable, demand can grow. As demand grows, pricing often becomes more competitive. This is one way accessibility improvements can translate into arrival gains.

- Spread demand beyond the obvious hotspots

- A diversified mix can reduce pressure on a small set of destinations. More itineraries that make provinces feel realistic, rather than exhausting, can support wider benefits across regions.

The Key Point: China’s Return Won’t Fix Fundamentals

Even if China rebounds more strongly in coming years, relying on that rebound alone would still leave wider experience factors unchanged.

The reason is that the visitor experience factors discussed in 2024–2025 remain relevant, including:

- Pricing that can feel fragmented

- Multiple layers of fees

- Limited direct access to some secondary gateways

- Congestion and delay ripple effects at key airports

- Transfer-heavy itineraries that can reduce short-stay appeal

A stronger China market could lift totals. It would not automatically change competitiveness on its own. Competitiveness tends to improve when friction decreases and value feels clearer. When those improve, the Philippines becomes attractive across multiple markets at once, not only one.

Receipts vs Volume: The Awkward But Important Detail

Fewer Visitors Can Still Mean More Money

It is easy to assume tourism performance is straightforward: more arrivals equals more success. But that relationship does not always hold.

Tourism can generate strong income even when arrival totals remain below targets. In 2023, tourism receipts were reported at about ₱482.5 billion (around US$8.7 billion) [8]. That represents a strong rebound in spending, even while arrival numbers were still in recovery.

This is a detail that shifts the discussion. The Philippines can be behind on visitor volume and still generate substantial revenue from the travelers who do arrive.

Why Spending Can Rise Even When Arrivals Don’t

There are several reasons receipts can climb while arrivals remain softer. None are unusual on their own, but together they explain how volume and money can move differently.

Higher prices across the board

If hotels, domestic flights, tours, and dining become more expensive, average spend per visitor rises. This can occur without an intentional move “upmarket.” Prices can rise because of supply limits, higher operating costs, or capacity constraints in popular areas. Travelers experience higher totals, and receipts reflect that.

Longer stays by certain segments

Even if fewer people visit, visitors may stay longer on average. This often happens when a destination attracts:

- Remote workers and long-stay travelers

- Returning visitors who already know the country

- Divers and niche travelers building slower itineraries

- People visiting family or combining leisure with personal trips

Longer stays mean more nights, more meals, more local transport, and more add-ons. One long-stay traveler can outspend several short-stay travelers.

Inflation and exchange-rate effects

Receipts are measured in currency, and currency conditions change over time. Inflation can raise nominal spending even if “real” value does not rise as much. Exchange rates can also shape how spending is recorded and perceived. A destination may collect more pesos because prices have increased, or because foreign currency converts differently than it did previously.

In short, receipts can rise without a major arrival surge because the average trip cost increases and the visitors who do arrive spend more per person.

The Catch: Higher Receipts Don’t Automatically Mean Higher Satisfaction

Strong receipts can signal healthy spending, but they can also be interpreted alongside traveler experience. If receipts rise mainly because trips cost more, and not because experiences improve at the same pace, spending growth may be less durable.

When travelers feel they paid higher prices while also dealing with:

- Multiple add-on fees that were not clear upfront

- Complicated transfers

- Airport congestion and delays

- Inconsistent standards across operators

They may still spend a lot on that trip, but they may be less likely to return soon. Receipts can remain strong in the short term while repeat intent shifts more slowly.

That is why receipts are often best read alongside experience indicators. Revenue alone does not fully describe long-term competitiveness.

The Strategic Question: What Kind of “Success” Does the Philippines Want?

This is where receipts versus volume becomes a strategic framing rather than only a scorecard.

If the Philippines can earn strong receipts with fewer visitors, two broad pathways can be discussed.

Path 1: Fewer visitors who spend more

This approach leans toward higher-yield travel. It can reduce pressure on sensitive sites, limit overcrowding, and keep tourism more manageable for communities. Done well, it can also support better services because operators can invest more with steadier margins.

But it works best when higher spend aligns with clearly felt value. If higher spend is driven primarily by higher prices and extra effort, the trip can feel less predictable, which is not how premium positioning is usually experienced.

Path 2: Broader access with better value

This approach aims to increase arrivals by reducing friction and improving affordability. Not necessarily “cheap,” but fair. It emphasizes transparency, easier logistics, smoother gateways, and fewer surprise costs.

The upside is scale. The trade-off is pressure. Without strong management, higher volume can strain beaches, roads, waste systems, and community life. If volume rises faster than systems adapt, crowding can increase without a matching gain in perceived competitiveness.

The Real Decision Is About Experience, Not Just Numbers

This is why the receipts-versus-volume lens matters. It encourages a more practical question:

Is the Philippines aiming to be a destination that travelers feel is worth paying more for because the experience is premium and smooth? Or is it moving toward a situation where costs rise mainly because pricing is fragmented and add-ons accumulate?

If the goal is a “fewer visitors, higher yield” model, the trip needs to feel designed and predictable. Premium is not only a price point. Premium is ease, reliability, transparency, and consistency.

If the goal is a “more visitors, better value” model, the same fundamentals still matter: clearer costs, simpler transport, smoother gateways, and fewer surprise steps. Without those, growth can remain constrained even when demand exists.

Either way, the fundamentals are similar. Competitiveness continues to track closely with value for money and traveler confidence.

Why This Leads Directly Into the Mass Tourism Debate

Once it is understood that receipts and arrivals can move in different directions, the “missed target” narrative becomes broader than one number.

Once it is understood that receipts and arrivals can move in different directions, the “missed target” narrative becomes broader than one number.

It becomes a question of positioning.

Should the Philippines aim for higher volume like some neighbors? Or should it emphasize longer stays, slower travel, and higher-value experiences that reduce pressure on communities?

That discussion matters because it changes what “improving tourism” prioritizes. If volume is the goal, priorities tilt toward scale and ease. If value is the goal, priorities tilt toward experience quality, transparency, and sustainability.

Either way, the underlying principle remains consistent: travelers tend to pay when the experience feels worth it, and they often choose easier alternatives when it does not.

Bigger Question: Mass Tourism or High-Value Tourism?

The Problem With Chasing Big Numbers

When a country misses a tourism target, a common response is to focus on volume: more arrivals, more flights, more campaigns, and more year-on-year comparisons. Those approaches can increase visibility and demand, but volume on its own does not always reflect overall success.

Tourism outcomes can look different when visitor numbers rise faster than travel systems and services can comfortably support. In that scenario, more visitors may move through the same capacity limits, experience similar friction points, and leave with similar feedback. That is why the discussion around missed targets is often more useful when it looks beyond arrivals alone.

This leads to a broader question: what kind of tourism does the Philippines want to build?

The country can pursue a higher-volume approach similar to some regional peers. It can also emphasize travel that encourages longer stays, steadier spending, and lower pressure on sensitive sites. The practical answer may be a blend. Without a clear direction, tourism can sit in an in-between space: not consistently positioned as the lowest-cost option, not consistently perceived as the simplest option, and not consistently framed around experience quality.

Why Mass Tourism Strains Places Like the Philippines

Mass tourism is often associated with visible signs of activity: busy airports, full hotels, and high tour participation. At the same time, higher volumes can increase pressure in destinations where infrastructure and natural systems have practical limits.

In the Philippines, pressure points are often discussed in concrete, observable ways.

Beaches and marine sites can carry more wear.

Higher foot traffic can accelerate erosion and increase stress on reefs and coastal environments. Volume can raise the likelihood of pollution risks, fuel exposure from boats, and runoff issues. The larger the number of users in a small area, the more active management is needed to maintain site quality.

Waste systems can face surge loads.

Many islands and coastal towns experience seasonal spikes. Collection schedules, disposal capacity, and logistics can be tested when volumes increase quickly. When waste handling falls behind demand, it becomes visible for both visitors and residents.

Water and power demand can rise sharply.

Tourism increases demand for utilities beyond baseline community use. In destinations with limited supply buffers, higher demand can be felt through tighter availability, higher costs, or more frequent service disruptions.

Roads and transport can slow under higher loads.

When visitor numbers grow faster than transport capacity, congestion increases. This affects not only visitor movement but also daily logistics such as commuting, deliveries, and response times.

Housing markets in hotspots can shift.

Increased visitor demand can expand short-term rentals and tourism-linked development, which can influence rent and land prices. Over time, this can affect where workers and residents are able to live relative to employment centers.

These dynamics are commonly associated with high volume meeting limited infrastructure capacity. When capacity and management tools scale alongside demand, the impacts can be reduced. When they do not, pressures become more noticeable.

Carrying Capacity: The Word That Makes Tourism Honest

Carrying capacity is a practical concept: how many people a place can support without degrading the environment, services, or community life.

It is not only about nature. It also covers infrastructure and local systems. A destination’s working limit can include:

- How much waste it can process

- How much freshwater it can supply

- How much traffic it can absorb

- How quickly emergency services can respond

- How safely boats and tours can operate

- How well beaches and reefs can recover

The Philippines has a widely known reference point for this discussion: Boracay.

Boracay became a prominent example because it highlighted the impact of demand outpacing systems and standards. The island’s closure period and subsequent restrictions brought carrying capacity into public discussion.

This matters because it shows a practical principle: limits are not anti-tourism. Limits can help tourism remain viable over time.

When carrying capacity is not actively managed, destinations can degrade until they become less attractive. Visitor satisfaction declines, residents experience more pressure, and businesses face greater volatility. Over time, restoration becomes more difficult than prevention.

What High-Value Tourism Actually Means

High-value tourism is sometimes misunderstood as “tourism for wealthy travelers only.” That interpretation is not the only meaning, and it can miss the broader point.

High-value tourism can also mean improving outcomes: better experiences for visitors and better quality-of-life impacts for communities.

The Philippines Is Naturally Built for High-Value Travel

Whether by design or by travel realities, the Philippines often rewards certain travel styles. Many of the strongest itineraries are built by travelers who:

- Stay longer than a week

- Accept that island travel takes time

- Focus on one region instead of moving constantly

- Spend time in smaller towns and provinces

- Value nature and culture, not only photo highlights

That can be a strength. It becomes more effective when tourism strategy aligns with how trips work in practice, while also reducing avoidable friction that makes even slower travel feel harder than necessary.

A strategy that matches these travel patterns can build on what works while improving the basics that shape confidence.

Avoiding the Elitism Trap

This area benefits from careful framing: high-value tourism does not need to imply exclusion or “only for people with money.”

A practical way to frame it is this: a tourism model can prioritize better outcomes, not just bigger crowds. [8]

Better outcomes can look like:

- Cleaner beaches and healthier reefs

- Waste and water systems that also serve residents well

- Safer, more reliable transport

- Wider income distribution across provinces

- Visitors who leave with strong recommendations

- Communities that feel pride and benefit from tourism

When these conditions improve, tourism becomes sustainable in a practical sense: it can continue without degrading the place that makes it appealing.

What a Balanced Model Could Look Like

The Philippines does not have to choose only one extreme. A mixed model can protect fragile destinations while supporting volume where infrastructure can handle it.

A balanced approach might include:

- Stricter carrying capacity rules for fragile islands and marine sites

- Better fee transparency so conservation funding is easy to understand

- Improved gateways and connectivity so travel is smoother without concentrating congestion in a few chokepoints

- Stronger support for province itineraries so demand spreads beyond a small set of hotspots

- Clearer standards and enforcement so growth remains organized and predictable

In practice, volume without management can increase crowding. Value-focused tourism without fairness can feel exclusive. A middle path is often a model where growth is guided, benefits are shared, and experiences feel clear and worth the cost.

Why This Question Changes Everything

Once a country asks “what kind of tourism do we want,” success is measured by more than arrivals. It can also be measured by what tourism produces:

- Jobs that provide stable incomes

- Communities that can still afford to live locally

- Beaches that remain healthy year after year

- Transport systems that function under peak demand

- Visitor experiences that feel smooth, honest, and fair

That is the broader measure of success.

If the Philippines focuses on volume without improving friction and capacity alignment, growth may be less stable. If it focuses on quality, transparency, and capacity management, arrivals can grow more steadily while the destination remains strong for future visitors.

A Missed Target or a Wake-Up Call?

Targets Are a Scoreboard, But Tourism Runs on Confidence

It is easy to treat tourism targets like a scoreboard. If the number is missed, the story reads as failure. If the number is reached, the story reads as success. But the Philippines’ tourism performance in the 2024–2025 window can also be read as feedback.

The country is widely recognized for its attractions. At the same time, competitiveness is shaped by how the overall trip feels to travelers.

The Philippines Doesn’t Lack Beauty. It Lacks Ease.

On natural appeal, the Philippines remains one of Southeast Asia’s standout destinations. Few places match the scale of its coastline, the variety of islands, the quality of beach scenery, and the sense of discovery that still exists in many provinces.

The practical point is that beauty is only one part of what travelers evaluate. The other part is the experience around the beauty: how easy it is to get there, how clear pricing is, how predictable itineraries feel, and whether the trip delivers value for money without requiring excessive effort.

That is where gaps can appear.

The Point Isn’t Bigger Crowds. It’s Better Outcomes.

A missed target can be viewed as a prompt for adjustment rather than a final verdict. Travelers compare experiences, not only photos. Southeast Asia has many destinations that look impressive online. The choice often comes down to the place that feels simplest and most transparent once a trip is booked, started, and moved through.

A missed target can be viewed as a prompt for adjustment rather than a final verdict. Travelers compare experiences, not only photos. Southeast Asia has many destinations that look impressive online. The choice often comes down to the place that feels simplest and most transparent once a trip is booked, started, and moved through.

This does not automatically imply that the Philippines should pursue mass tourism at any cost. Many of the country’s strongest experiences are associated with slower, more personal trips: longer stays, deeper province travel, smaller communities, and nature that still feels intact rather than heavily saturated.

A strategy that aligns with carrying capacity is often discussed as a way to protect the assets tourism relies on. When reefs degrade, beaches crowd, waste systems strain, and communities feel pressure, tourism can become more volatile over time.

Value for Money Isn’t “Cheap.” It’s “Fair.”

Improved outcomes often begin with value for money. Not cheap, but fair. Travelers tend to accept higher costs when the experience feels designed: clear totals upfront, fewer unexpected add-ons, consistent standards, and reliable basics.

They also tend to spend more when friction is reduced: smoother gateways, better connectivity, and travel time that feels predictable rather than fragile. This is why logistics is not only an infrastructure topic. It is also a confidence topic.

When travelers believe the Philippines will be manageable to navigate, they are more likely to book longer trips. They are more likely to travel with family or friends. They are more likely to return and recommend the destination without caveats. That is one way arrivals can grow steadily without pushing destinations toward overcrowding.

The Philippines Needs a Clear Tourism Identity

There is also a broader layer beneath the numbers: positioning.

The Philippines benefits from a clear answer on what kind of destination it aims to be. A destination can offer multiple experiences, but strategy works best when priorities are explicit. If the goal is higher volume, systems need to handle crowds reliably. If the goal is higher-value travel, the experience needs to feel worth paying for, not only higher-priced.

Either direction can work. What tends to be less effective is an unclear middle space where prices rise, add-ons accumulate, logistics remain complex, and the message to travelers becomes harder to interpret.

The Fixes Are Practical and Visible

The encouraging point is that many improvements are practical and quickly felt by travelers.

- Reduce surprise fees and make totals transparent

- Bundle charges where possible and standardize collection and receipts

- Improve gateway flow, reliability, and connections to secondary destinations

- Design for real travel behavior, not idealized itineraries

- Spread demand beyond a small set of hotspots so provinces benefit too

These changes can also support residents. Better airports, clearer transport systems, cleaner public spaces, more consistent standards, and stronger waste management can improve daily life. Tourism becomes less seasonal and less disruptive, and more stable as an economic sector.

Wake-Up Call, Not Just a Miss

So is a missed target a failure? Not necessarily.

It can be read as a signal. A reminder that the Philippines may benefit as much from smoother execution as from stronger marketing. It does not need to become a crowded, overbuilt destination to perform well. It can strengthen outcomes by becoming easier to visit, easier to budget for, and easier to recommend.

When friction decreases, results often improve. And when value is clearer, outcomes can strengthen even without rapid volume growth.

Sources:

[1] Commentary: The Philippines, home of many beautiful destinations – and the scourge of mass tourism – CNA

[2] 8 Filipino Travel Tips for Avoiding Hidden Fees – psmabuhay.com

[3] Manila Bulletin – Philippine tourism faces uphill battle amid infra woes, crime, China tensions

[4] PHL losing out to Asean with costlier fare, hotels | Ma. Stella F. Arnaldo

[5] Tourism continues to lag but holds potential to rebound – BusinessWorld Online

[6] Philippines reports 5.4 million tourist arrivals in 2023 | AGB

[7] Whose job is it? | Philstar.com

[8] Philippines struggles to win back Chinese tourists as regional rivals surge | South China Morning Post

The China Market Didn’t Return Like Before

The China Market Didn’t Return Like Before